URD 2022

-

1. Presentation of the Group

-

1.1Overview and historical background

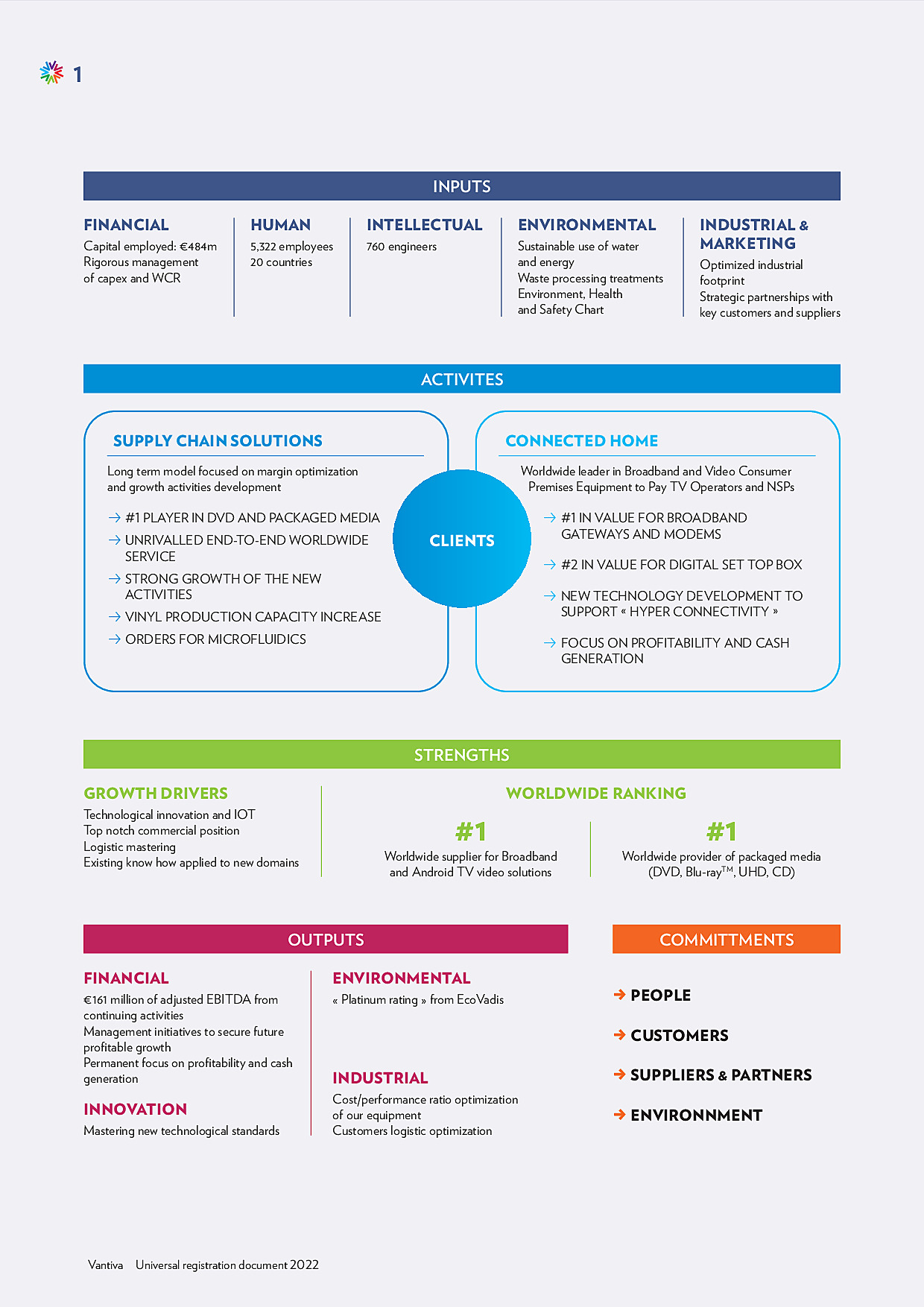

GRI [2-6 Activities, value chain and other business relationships] [3-3 Management of material topics: Economic performance]

1.1.1Overview

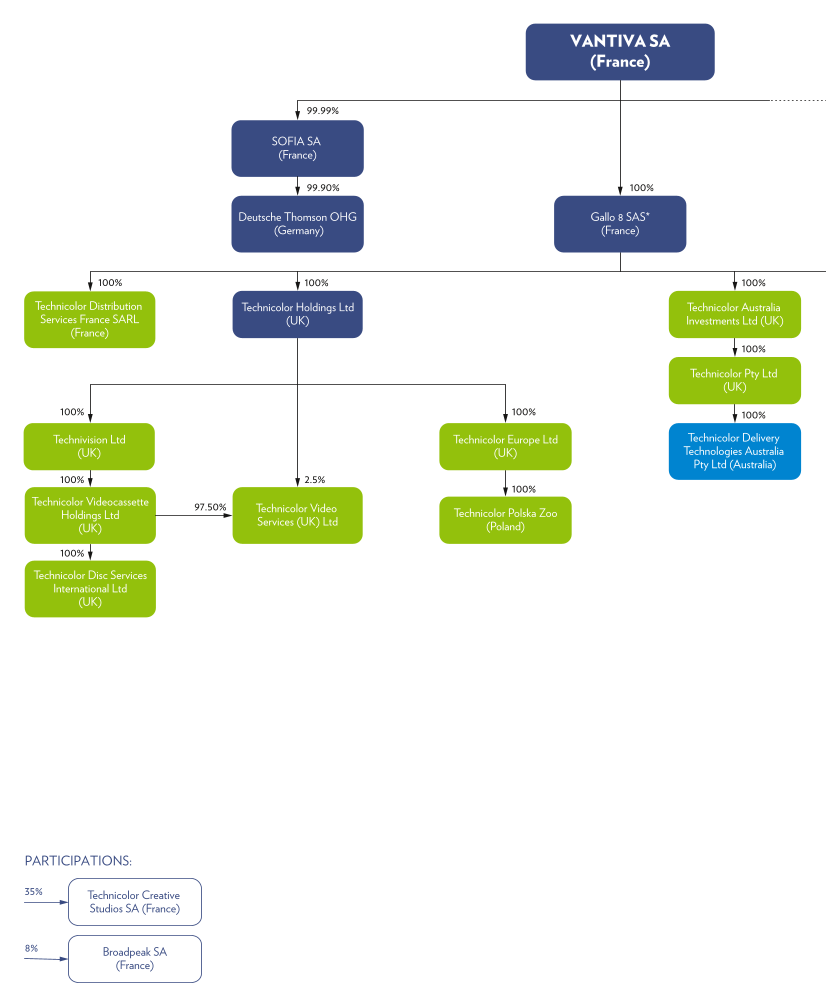

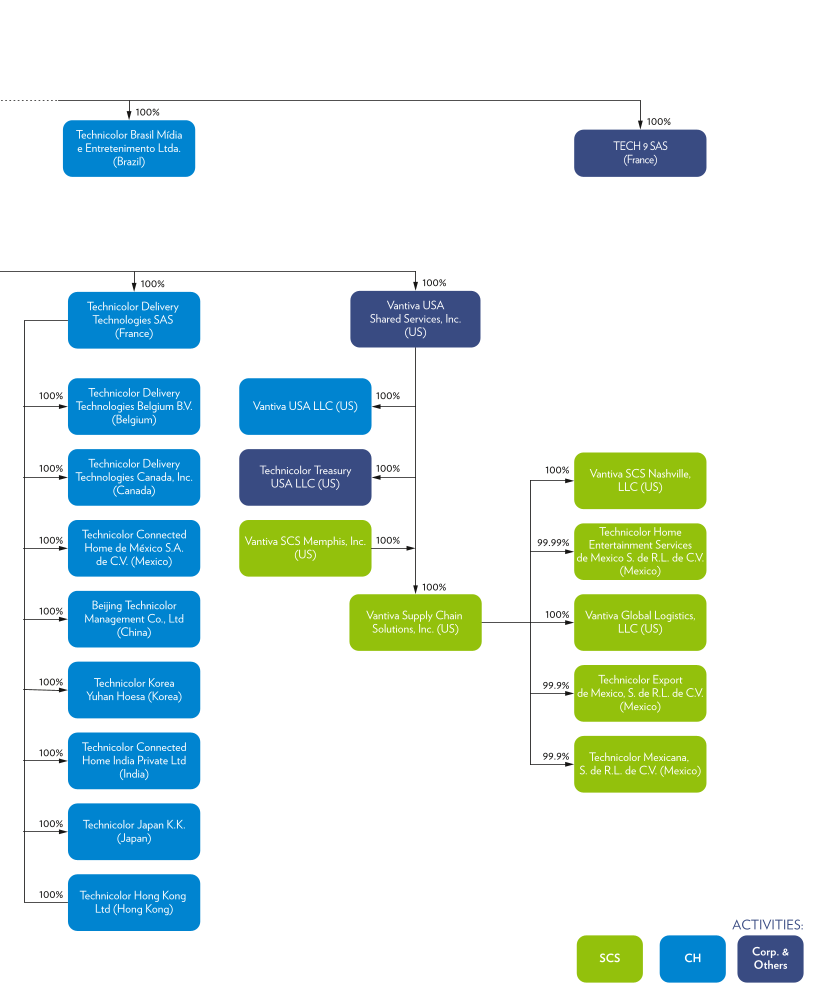

As worldwide leader in the Media & Entertainment (“M&E”) sector, Technicolor operated through three significant operating businesses until the Spin-off of Technicolor Creative Studios ("TCS") activities that took place on the 27th of September 2022:

- •Connected Home is at the forefront of the design and supply of solutions enabling the delivery of digital video entertainment, data, voice and Smart Home services to Pay-TV operators and Network Services Providers including broadband modems and gateways, digital Set-Top Boxes, and other connected devices (“Connected Home”);

- •Supply Chain Solutions is the worldwide leader in replication, packaging and distribution for video, games and music CD, DVD, Blu-ray™ discs. The division is increasingly focused on diversifying its business outside of packaged media, offering end-to-end supply chain solutions, comprising distribution, fulfillment, freight brokerage, and transportation management services. Furthermore, this unit is accelerating development of new non-disc related manufacturing businesses, including production of polymer-based microfluidic devices for use in medical diagnostics and vinyl record production (“Supply Chain Solutions”);

- •Technicolor Creative Studios (TCS) is a leading provider of services to content creators, including MPC (Film and Episodic Visual Effects), The Mill (Advertising), Mikros Animation, and Technicolor Games (“Technicolor Creative Studios”).

Unallocated Corporate functions and all other unallocated activities, are presented within the division “Corporate & Other”. For more information, please refer to section 1.2: “Organization and Business Overview” of this Chapter.

The company now has two main business operating segments, Connected Home and Supply Chain Solutions, but remains the largest TCS shareholder with a 35% stake in the company.

In the fiscal year 2022, Vantiva generated consolidated revenues from continuing operations of €2,776 million. As of December 31, 2022, the Group had 5,322 employees in 20 countries.

Vantiva is publicly listed on the Euronext Paris Exchange (VANTI) with a market capitalization of €72.8 million as of December 31, 2022, and an ADR traded in the USA on the OTC Pink marketplace (Ticker: TCLRY).

-

1.2Organization and business overview

GRI [2-6 Activities, value chain and other business relationships] [3-3 Management of material topics: Market presence]

1.2.1Vantiva

Business overview

On February 24 2022, Technicolor announced its intention to list TCS to enable its further growth and development, and to refinance the Group's existing debt. This operation, effective from the 27th of September 2022, has resulted in the creation of two independent leaders.

TCS and Vantiva have distinct characteristics in terms of growth, margins, capital intensity, and cash flow generation. This transaction allows each entity to pursue its own strategic path independently, consistent with its underlying business dynamics and financial fundamentals.

TCS is a global leader in VFX in a market experiencing exponential growth driven by burgeoning demand for contents. TCS has a Board of Directors and a management team independent from Vantiva.

Vantiva, for its part, will look to strengthen its market leader status in Connected Home and Supply Chain Solutions. The company has a stronger balance sheet following the refinancing, with lower leverage than before, hence de-risking its financial profile. Connected Home and Supply Chain Solutions will therefore be in a better position to reinforce their status as global players.

65% of TCS’ shares were distributed to Technicolor’s shareholders and TCS is now listed on Euronext market as Technicolor Creative Studios (Ticker:TCHCS).

Vantiva is now refocused on 2 major operational units: Connected Home (CH) and Supply Chain Solutions (SCS). Both are among the leading players on their respective markets and aim at expanding their business while improving their profitability.

Vantiva remains the largest TCS shareholers with a 35% stake, but the two companies are independent and Vantiva management have no influence over the strategic or operational decisions of TCS. For the moment, the two companies are still supported by a “shared services centers” and a transitional service agreement.

-

1.3Strategy

GRI [2-6 Activities, value chain and other business relationships] [3-3 Management of material topics: Economic performance]

Recent Strategic Evolutions

On February 24 2022, Technicolor announced its intention to list Technicolor Creative Studios to enable its further growth and development, creating two independent market leaders, and to refinance Technicolor’s existing debt.

This operation was approved by the AGM held on September 6, and 65% of TCS shares were distributed toTechnicolor shareholders on the 22nd of September. Technicolor Creative Studios first traded on Euronext on September 27, 2022.

The remaining company was renamed Vantiva and the latter remains TCS’ main shareholders with a 35% stake.

Vantiva’s strategy aims at reinforcing its leadership on its markets by offering its clients high quality products and services while generating enough cash to finance its future.

- •delivering state of the art products and services, offering high reliability and quality, for a competitive price;

- •designing innovative, ecofriendly and cost effective products and having them produced at the better costs;

- •developing strong and transparent partnerships with our key customers and suppliers;

- •expanding our addressable markets by adding products and services linked to our core competences and markets;

- •improving the group’s profitability and cash generation through business expansion and rigorous management;

- •Iivesting in promising new opportunities to secure the Group’s future growth.

Connected Home key pillars are:

- •continue to develop its Broadband leadership. The unit is consolidating its market leadership on Cable and xDSL while accelerating on Fiber and Wireless/5G technologies. Connected home is also at the forefront of the new generation of Wifi;

- •exploit the potential in Android TV by adding features to the set top box like soundbar;

- •focus growth on scale customers using platform model;

- •leverage the Group’s connectivity know how to push into the IOT market for Verticals (enterprises).

Supply Chain Solutions key pillars are:

- •continue significant business transformation, cost-optimization and automation in this specialist manufacturing, supply chain and fulfillment services division;

- •leverage the expertise, facilities, existing supply chain infrastructure and manufacturing capability and capacity to expand our presence within the four current strategically selected growth-oriented market segments: Microfluidics, Supply Chain Services & Fulfillment, Freight Brokerage, and Vinyl (record) Manufacturing and Distribution Services.

-

1.4Share capital and shareholding

GRI [2-6 Activities, value chain and other business relationships] [2-29 Approach to stakeholder engagement] [201-1]

1.4.1Share capital

Change in the number of shares and voting rights in 2022

In 2022, prior to the distribution in kind of the Technicolor Creative Studios shares (the “Distribution in Kind”) and the admission to trading on Euronext Paris of the said TCS shares, the Company carried out several transactions that impacted the amount of its share capital, in particular a significant capital increase following the conversion of convertible bonds into shares issued as part of the refinancing transactions.

1Issuance of shares under the 2019 and 2020 Long-Term Incentive Plans (LTIP) and the 2020 Additional Shares Plan (ASP)

On June 14, 2022, the 2019 Long-Term Incentive Plan (LTIP) expired at the end of a three-year vesting period.

In the absence of a sufficient level of equity to be able to deliver the vested shares, the Board of Directors decided to defer this delivery and to authorize the Chief Executive Officer to carry out the delivery, by way of increase in share capital, once the equity position has been restored.

On September 19, 2022, the Chief Executive Officer, acting under the delegation of the Board of Directors and having noted the existence of a sufficient level of equity, decided to issue at par 78,637 new shares, with a par value €0.01 (i.e. a capital increase of €786.37) and to deliver them to the beneficiaries of the LTIP 2019 who have satisfied the condition of uninterrupted presence within the Group for the entire duration of the Plan.

As indicated in section 4.2.4.2 of this Universal Registration Document, conditional rights to receive performance shares were granted on December 17, 2020 and March 24, 2021 by the Board of Directors under the LTIP 2020, on the basis for the authorization granted by the General Meeting of June 30, 2020 under the 25th resolution.

In the context of Distribution, to retain the loyalty of the beneficiaries of these plans and align their interests with those of the shareholders, the Board of Directors wished to accelerate the vesting of the shares granted under this Plan by a few months and allow beneficiaries to benefit from the Distribution in Kind and thus receive Technicolor Creative Studios shares at the time of its implementation.

On the proposal of the Board of Directors, the Company’s General Meeting of September 6, 2022, approved the Distribution and, under the terms of the 12th resolution adopted on an extraordinary basis, approved the amendment with retroactive effect of the 25th resolution adopted by the General Meeting of June 30, 2020 and the option to reduce the initial vesting period to a minimum period of sixteen months, thus authorizing the necessary amendments to the regulations of the Plan.

The expiry of the minimum vesting period was thus shortened to August 30, 2022, i.e. seven days before the date of the General Meeting of September 6, 2022.

On September 19, 2022, the Chief Executive Officer, acting under the delegation of the Board of Directors and after the latter had assessed the level of achievement of the performance conditions of the Plan as adjusted(2), decided to issue at par 2,800,276 new shares, with a par value of €0.01 (i.e. a capital increase of €28,002.76), and deliver them to the beneficiaries of the LTIP 2020 having satisfied the condition of uninterrupted presence within the Group during the readjusted term of the Plan.

As indicated in section 4.2.4.2 of this Universal Registration Document, conditional rights to be received, subject to various conditions, additional performance shares were granted on April 15 and 23, 2021.

These rights were granted by the Board of Directors to six members of the Executive Committee of Technicolor SA, including the then Chief Executive Officer Richard Moat, as part of the Additional Shares Plan (ASP) 2020, on the basis of the authorization granted by the General Meeting of June 30, 2020 under the 26th resolution.

In the same way as for the LTIP 2020, the Board of Directors wished, in the context of the Distribution, to accelerate by a few months the vesting of the additional shares granted under this Plan, and thus allow the beneficiaries to participate in the transaction.

On the proposal of the Board of Directors, the Company’s General Meeting of September 6, 2022, approved the Distribution and, under the terms of the 13th resolution adopted on an extraordinary basis, approved the amendment with retroactive effect of the 26th resolution adopted by the General Meeting of June 30, 2020 and the option to reduce the initial vesting period to a minimum period of sixteen months, thus authorizing the necessary amendments to the regulations of the Plan.

The expiry of the minimum vesting period was thus shortened to August 30, 2022, i.e. seven days before the date of the General Meeting of September 6, 2022.

On September 19, 2022, the Chief Executive Officer, acting under the delegation of the Board of Directors and after the latter had assessed the level of achievement of the performance conditions of the Plan as adjusted(3), decided to issue at par 1,215,858 new shares, with a par value of €0.01 (i.e. a capital increase of €12,158.58), and deliver them to the beneficiaries of the ASP 2020 having satisfied the condition of uninterrupted presence within the Group during the readjusted term of the Plan.

2Issuance of shares and warrants pursuant to the delegations of powers granted by the General Meeting as part of the last stage of the July 2020 Safeguard Plan

On July 20, 2020, the Company’s General Meeting granted the Board of Directors several interdependent delegations of power to implement the transactions in the Company’s share capital intended to enable the restructuring of the debt, in accordance with the draft accelerated financial safeguard plan approved and registered in July 2020.

In accordance with these delegations of power, the Board of Directors was authorized to proceed within six (6) months to the issue and grant up to a maximum of 15,407,114 free warrants (BSA) for the benefit of the Company’s shareholders, exercizable for a period of four (4) years from the settlement-delivery date of the last of the Capital Increases, on the basis of one (1) warrant for one (1) existing share, it being understood that five (5) Shareholders warrants will give the right to subscribe to four (4) new ordinary shares, at a price of €3.58 per new share with a par value of €0.01 associated with an issue premium of €3.57 (the “Shareholders Warrants”).

These Shareholders Warrants were issued on September 22, 2020 and have been exercised since that date.

In the context of the proposed distribution in kind of 65% of the shares of Technicolor Creative Studios (TCS) and the admission to trading on Euronext Paris of the shares of TCS, the Board of Directors which met on July 28, 2022 with a view to preserve the interests of the holders of Company options and warrants, has delegated to the Chief Executive Officer the power to suspend the exercise of the securities giving access to the share capital issued by the Company, including the Shareholders Warrants, for a maximum period of three (3) months.

Using this delegation, the Chief Executive Officer suspended the exercise of the Shareholders Warrants as from September 6, 2022 at 12.01 a.m. Then once the refinancing and distribution transactions were completed, this suspension was lifted on October 6, 2022 at midnight.

The exercise of the warrants thus resumed, on the basis of an adjusted exercise parity, the holders of Shareholders Warrants can now subscribe to 10.489 new shares of the Company by exercising five (5) warrants for an overall unchanged exercise price of €14.32 (i.e. an implied subscription price of approximately €1.365 per new share).

Thus, for the financial year ended December 31, 2021, 74,170 Shareholders Warrants were exercised, resulting in the issuance of 91,739 new shares with a par value of €0.01 and an increase in share capital totalling €212,351.27, including a total issue premium of €211,433.88. This capital increase was recognised in two installments, by decision of the Chief Executive Officer acting on the delegation of the Board of Directors, on September 22, 2022 for the warrants exercised from January 1, 2022 until September 5, 2022, and on January 10, 2023 for warrants exercised between October 6, 2022 and December 31, 2022. The Company’s bylaws have been amended accordingly.

3Issuance and conversion of convertible bonds into shares giving rise to a subsequent increase in share capital

- to issue with cancellation of preferential subscription rights 115,384,615 bonds convertible into ordinary shares of the Company for the benefit of named beneficiaries for a nominal amount of €2.60, i.e. a total nominal amount of €299,999,999, and net unit subscription price of €2.535 (“OCA”);

- that the OCAs issued pursuant to the aforementioned resolutions will give entitlement, in the event of conversion into shares, to a maximum of 115,384,615 new shares of the Company with a par value of €0.01 per share, i.e. a capital increase of €1,153,846.15.

The beneficiaries of these OCAs, in favour of which the preferential subscription right has been waived, are the following persons (hereinafter “the Beneficiaries”):

- •persons affiliated with Angelo, Gordon & Co., L.P. : 49,859,532 OCA;

- •Bpifrance Participations SA: 17,307,692 OCA;

- •persons affiliated with Barings Asset Management Limited: 10,384,615 OCA;

- •persons affiliated to affiliates of Credit Suisse Asset Management Limited and Credit Suisse Asset Management: 4,807,692 OCAs;

- •Briarwood Capital Partners LP : 10,679,885 OCA;

- •person affiliated with Farallon Capital Management (Glasswort Holdings LLC): 9,230,769 OCA;

- •persons affiliated with Goldman Sachs Asset Management (ELQ Lux Holding S.à.r.l., Special Situations 2021, LP and Special Situations 2021 Offshore Holdings II, LP) : 5,083,789 OCA; and

- •persons affiliated with Bain Capital High Income Partnership, LP (John Hancock Funds II Floating Rate Income Fund and Aare Issuer Designated Activity Company): 8,030,641 OCA.

The Board of Directors, at its meeting on September 6, 2022 and making use of the delegations of powers granted to it by the General Meeting of May 6, 2022, authorized the issuance of OCAs by the Company and decided that the OCAs would be issued on September 15, 2022, in accordance with the OCA subscription agreement.

At another meeting on September 22, 2022 and making use of the same delegations granted by the General Meeting, the Board of Directors noted that all the conditions precedent for the automatic conversion of the OCAs had been met and that this conversion, intended to result in the issuance of 115,384,615 new shares of the Company (the “New TSA Shares”), could thus be implemented ahead of the Distribution in Kind.

The Board has also sub-delegated to the Chief Executive Officer all powers to implement these decisions and, in particular, to record the completion of each of the capital increases that may result from the issue of the new TSA shares.

Using the aforementioned powers and pursuant to decisions taken on September 26, 2022, i.e. the day preceding the Distribution in Kind, the Chief Executive Officer:

- noted that all OCAs were subscribed by the Beneficiaries;

- noted that the OCA subscription was fully paid up in cash;

- noted that the 115,384,615 new TSA shares were fully paid up by offsetting the receivable represented by the 115,384,615 OCA held by the Beneficiaries;

- as a result, the Company recorded a capital increase for a total nominal amount of €1,153,846.15, increasing the amount of the Company’s share capital from €2,399,586.30 to €3,553,432.45, and the number of shares comprising the Company’s share capital being increased from 239,958,630 shares to 355,343,245 shares with a par value of €0.01 each; and

- decided to allocate the issue premium, in the amount of €291,346,152.88, to the “issue premium” account and to deduct the sums necessary to fund the legal reserve, the new TSA shares carry immediate dividend rights and being, from their creation, fully fungible with the Company’s existing ordinary shares.

4Composition of share capital at December 31, 2022

At December 31, 2022, the Company’s share capital consisted of 355,395,680 shares with a par value of €0.01, fully paid-up (ISIN code FR0013505062) and all of the same class (see paragraph “Changes to the share capital”) of this chapter).

Date

Number of shares outstanding

Number of voting rights

December 31, 2022

355,395,680

Number of theoretical voting rights(1): 355,395,680

Number of voting rights that may be exercised at General Meetings(2): 355,395,680

(1) Calculated, pursuant to Article 223-11 of the General Regulations of the Autorité des marchés financiers, based on the total number of outstanding shares to which voting rights are attached, including shares with suspended voting rights.

(2) Excluding shares without voting rights.

Holding of share capital and voting rights

Shareholders

December 31, 2022(1)

December 31, 2021

December 31, 2020

Number of shares

% of share capital

of voting rights

Number of shares

% of share capital

of voting rights

Number of shares

% of share capital

of voting rights

Angelo, Gordon & Co., L.P.

79,671,524

22.40%

22.40%

29,811,992

12.64%

12.64%

11,808,783

5.01%

5.01%

Bpifrance Participations

38,437,497

10.80%

10.80%

10,381,145

4.40%

4.40%

10,381,145

4.40%

4.40%

Briarwood Chase Management LLC

36,950,740

10.40%

10.40%

21,827,685

9.26%

9.26%

-

-

-

Barings Asset Management Ltd.

29,016,111

8.20%

8.20%

18,631,496

7.90%

7.90%

24,406,573

10.35%

10.35%

Credit Suisse Asset Management

22,512,745

6.30%

6.30%

25,491,247

10.81%

10.81%

28,493,063

12.80%

712.80%

Farallon Capital Management, L.L.C.

19,491,396

5.50%

5.50%

14,422,759

6.12%

6.12%

14,574,603

6.18%

6.18%

Bain Capital Credit, LP

15,248,991

4.30%

4.30%

17,785,294

7.54%

7.54%

16,593,636

Goldman Sachs group, Inc.

10,390,314

2.90%

2.90%

10,390,314

4.41%

4.41%

10,381,145

4.40%

4.40%

Invesco Advisers, Inc.

8,108,886

2.30%

2.30%

9,152,900

3.88%

3.88%

9,142,348

3.88%

3.88%

ICG Advisors, LLC

7,952,783

2.20%

2.20%

-

-

-

-

-

-

BNP Paribas Asset Management France SAS

-

-

-

5,935,176

2.52%

2.52%

-

-

-

Other shareholders(2)(3)

84,614,693

24.7%

24.7%

71,994,547

30.52%

30.52%

120,395,332

51.06%

51.06%

Total

355,395,680

100%

100%

235,824,555

100%

100%

235,795,483

100%

100%

(1) Sources: Company & Euroclear, Nasdaq - identification of the shareholding structure at November 30, 2022 and declarations of threshold crossings at December 31, 2022.

(2) Estimate obtained by subtracting.

(3) Including investments held by the major shareholder funds.

Top 10 shareholders *

Rank

Last name

Number of shares

% of share capital and voting rights

1

Angelo, Gordon & Co., L.P.

79,671,524

22.40%

2

Bpifrance Participations

38,437,497

10.80%

3

Briarwood Chase Management LLC

36,950,740

10.40%

4

Barings Asset Management Ltd.

29,016,111

8.20%

5

Crédit Suisse Asset Management

22,512,745

6.30%

6

Farallon Capital Management, L.L.C.

19,491,396

5.50%

7

Bain Capital Crédit, LP

15,248,991

4.30%

8

Goldman Sachs Group, Inc

10,390,314

2.90%

9

Invesco Advisers, Inc.

8,108,886

2.30%

10

ICG Avisors, LLC

7,952,783

2.20%

* Sources: Company & Euroclear, Nasdaq - Identification of shareholding as of November 30, 2022 and declarations of crossing of shareholding thresholds.

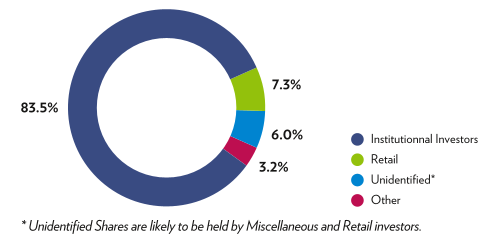

HOLDING OF SHARE CAPITAL (November 30, 2022)

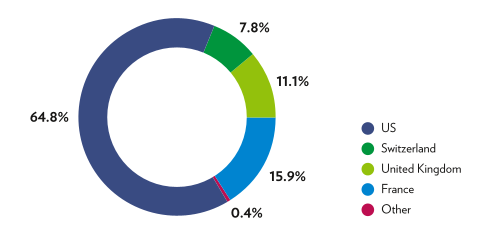

INSTITUTIONAL HOLDERS BY GEOGRAPHY (November 30, 2022)

Individuals or entities holding control of the Company and shareholders’ agreements

No entity controls the Company and, to the Company’s knowledge, there are no shareholders’ agreements relating to the Company.

Share ownership threshold crossings notified to the Company in 2022 and until the publication of this Universal Registration Document and shareholders holding more than 5% of the Company’s capital as of December 31, 2022

In accordance with Article L. 233-13 of the French Commercial Code, and to the Company’s knowledge, the following legal share ownership thresholds’ crossings were notified to the Company and to the Autorité des Marchés Financiers (AMF) during 2022 and until the publication of this Universal Registration Document.

Shareholders

Date on which threshold crossed

Threshold crossed upwards or downwards

Threshold

crossedPercentage of share capital held on the date of notification

Number of shares

Farallon Capital Management L.L.C.

(AMF Decl No. 223C0071)January 6, 2023

Downwards

5%

4.78%

17,000,000

Caisse des Dépôts et Consignations (CDC) via Bpifrance Participations & CDC Croissance

(AMF Decl No. 222C2273)September 23, 2022

Upwards

10%

11.35%

40,342,483

Bpifrance Participations (for EPIC Bpifrance)

(AMF Decl No. 222C2262)

September 23, 2022

Upwards

10%

10.82%

38,437,497

Angelo, Gordon & Co., L.P.

(AMF DecI No. 222C2261)

September 23, 2022

Upwards

15% & 20%

22.42%

79,671,524

Briarwood Chase Management LLC

(AMF Decl No. 222C2080)August 12, 2022

Upwards

10%

10.58%

24,961,154

Briarwood Chase Management LLC

(AMF Decl No. 222C1344)May 27, 2022

Downwards

10%

9.56%

22,555,938

Crédit Suisse Group AG

(AMF Decl No. 222C1302)

May 24, 2022

Downwards

10%

9.55%

22,512,745

Briarwood Chase Management LLC

(AMF Decl No. 222C1138)May 10, 2022

Upwards

10%

10.11%

23,830,736

To the Company’s knowledge, other than those mentioned above, no other shareholder held more than 5% of its share capital or voting rights as of December 31, 2022.

In addition, to the Company’s knowledge, no Corporate Officer (mandataire social) or Executive Committee member currently holds more than 1% of the Company’s share capital or voting rights, except for Bpifrance Participations (for further information on Board Members’ holdings see section 4.1.1.5: “Corporate Officers’ holdings in the Company’s share capital” under Chapter 4: “Corporate governance and compensation” of this Universal Registration Document).

Modifications in the holding of share capital over the past three years

In 2022, the main shareholding highlights are the strong increase in the shareholding of Angelo Gordon (26.9% of the capital), Bpifrance, which becomes the second largest shareholder of the company with 13% of the capital, and Briarwood Chase (10.4% of the capital), third largest shareholder. We also note the entry of Barings Asset Management (8.2% of the capital) and Farallon Capital Management (5.5%) in the top 5 shareholders.

Among the main sellers, we have Credit Suisse, which still held 6.3% of the capital, Davidson Kempner, Bardin Hill. Came Global Fund has exited the capital. Bain Capital, although having reduced its stake, still held 4.3% of the company as of November 30, 2022.

Top 5 buyers and sellers in 2022 *

Rank

Name

Number of shares at November 30, 2022

Percentage of share capital and voting rights

Net change

1

Angelo, Gordon & Co., L.P.

79,671,524

22.4 %

49,859,532

2

Bpifrance Participations SA

38,437,497

10.8 %

28,056,352

3

Briarwood Chase Management LLC

36,950,740

10.4 %

15,123,055

4

Barings Asset Management Ltd

29,016,111

8.2 %

10,384,615

5

Farallon Capital Management LLC

19,491,396

5.5 %

5,068,637

1

Credit Suisse Asset Management

22,512,745

6.3 %

(2,978,502)

2

Davidson Kempner Capital Management LP

3,041,672

0.9 %

(2,356,972)

3

Bardin Hill investment partners LP

604,506

0.2 %

(1,719,251)

4

Came Global Funds Managers (Luxembourg) SA

0

0 %

(1,714,431)

5

Bain Capital Credit, LP

15,248,991

4.3 %

(1,164,135)

* Sources: Company & Euroclear, Nasdaq - shareholder identification as of November 30, 2022.

In 2021 and as main highlight of the shareholder base, Angelo, Gordon & Co., L.P., Bain Capital Credit, LP, Barings Asset Management Ltd. and, Credit Suisse Asset Management remained as principal shareholders of the Group.

- •downwards since December 31, 2020:

- •BNY Alcentra Group Holdings, Inc. decreases from 6.59% in 2020 to 0.35% in 2021,

- •Barings Asset Management Ltd. decreases from 10.35% in 2020 to 7.90% in 2021,

- •Credit Suisse Asset Management decreases from 12.08% in 2020 to 10.81% in 2021.

- •upwards since December 31, 2020:

- •Angelo, Gordon & Co., LP increases from 5.15% in 2020 to 12.64% in 2021,

- •Briarwood Chase Management LLC acquired 9.26% of the share capital and voting rights in 2021.

- •Barings Asset Management Ltd. acquired 10.35% of the share capital and voting rights;

- •BNY Alcentra Group Holdings, Inc. acquired 6.60% of the share capital and voting rights;

- •Farallon Capital Management, L.L.C. acquired 6.18% of the share capital and voting rights;

- •Angelo, Gordon & Co., LP acquired 5.01% of the share capital and voting rights.

Some shareholders have considerably modified their holdings in the share capital and voting rights in 2020:

- •downwards since December 31, 2019:

- •RWC Asset Management LLP decreased from 10.13% to 0.08%,

- •JO Hambro Capital Management Limited decreased from an 8.48% stake to 0%,

- •Kinney Asset Management, LLC decreased from 5.53% to 0%,

- •Fidelity International decreased from 5.50% to 0.10%.

- •upwards since December 31, 2019:

- •Credit Suisse Group AG increased from 1.46% to 12.08%,

- •Bain Capital Credit increased from a 7.01% stake to 7.04%.

Changes in share capital over the last three years

Transaction date

Number of shares issued or cancelled

Capital increase / decrease

(in euros)

Total amount of share capital at closing

(in euros)

Changes in share premiums

(in euros)

Value of share premiums in the balance sheet

(in euros)

Value of the special reserve

(in euros)

Value of the special reserve Free shares plan

(in euros)

Cumulative number of shares at closing

Par value

(in euros)

At December 31, 2019

414,461,178

414,461,178

1.00

Reverse share split: 1 new share with a nominal value of €27 for 27 former shares with a nominal value of €1

(399,110,764)

27.00

Capital reduction by reducing the nominal value of the 15,350,414 shares of the Company from €27 to €0.01

(414,307,674)

414,307,674

0.01

Issuance of new shares as part of the Long-Term Incentive Plan - LTIP 2017

56,700

567

(567)

0.01

Capital increase in cash, with preferential subscription right (DPS) through the issuance of new shares

20,039,121

200,391

59,516,189

0.01

Capital increase with preferential subscription right by conversion of debt into equity

90,699,134

906,991

269,376,428

0.01

Capital increase reserved without preferential subscription rights through the conversion of debt into equity

92,178,770

921,788

329,078,209

0.01

Exercise of Shareholders Warrants (4 new shares for 5 warrants)

16,256

163

58,034

0.01

Exercise of New Money Warrants

17,455,088

174,551

0.01

Allocation of 10% of the share capital to the legal reserve

(218,324)

Imputation of financial, legal and other fees incurred during financial restructuring in relation with “Capital increase”

(14,742,893)At December 31, 2020

2,357,955

643,067,643

414,307,107

235,795,483

0.01

Issue of new shares under the LTIP 2018 by deduction from the “Free shares plan” reserve

9,800

98

(1,034)

936

0.01

Exercise of Shareholders Warrants (4 new shares for 5 equity warrants)

19,272

193

68,801

0.01

Creation of the “Free shares plan” reserve under the LTIP and ASP 2020 plans granted

(59,985)

59,985

At December 31, 2021

2,358,245.55

643,075,425.41

414,307,106.86

60,921.06

235,824,555

0.01

Issue of new shares under the LTIP 2019 by deduction from the “Free shares plan” reserve

78,637

786

(786)

0.01

Issue of new shares under the LTIP 2020 by deduction from the “Free shares plan” reserve

2,800,276

28,003

(28,003)

0.01

Issue of new shares under the 2020 ASP by deduction from the “Free shares plan” reserve

1,215,858

12,159

(12,159)

0.01

Exercise of Shareholders Warrants (4 new shares for 5 warrants)

39,304

393

140,315

0.01

Exercise of Shareholders Warrants (10.5 new shares for 5 warrants)

52,435

524

71,312

0.01

By decision of the Chief Executive Officer of September 26, acting on the delegation of the Board of Directors and pursuant to the decision of the General Meeting of May 6, 2022:

- A MCN capital increase

115,384,615

1,153,846

298,846,152.85

0.01

- Allocation of financial, legal and administrative expenses incurred as part of the capital increase

(15,729,588)

At December 31, 2022

3,553,956.80

926,403,617.14

414,307,106.86

19,973.35

355,395,680

0.01

Potential changes in share capital

As of December 31, 2022, a total of 31,363 stock options are outstanding in the framework of Stock Options Plans, (for details of these plans, see Chapter 4: “Corporate governance and compensation”, section 4.2.4: “Stock Option Plans and Performance or Free Share Plans” of this Universal Registration Document). If all existing stock options were exercised, 31,363 shares would be issued, representing a 0.01% increase in the number of shares at December 31, 2022. Such an impact on share capital is, however, purely hypothetical. The two stock option plans still outstanding are largely out of the money and will expire in June and October 2023 respectively, the date on which the balance of the options still outstanding will be fully written off.

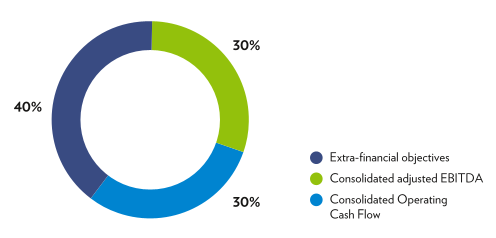

As of December 31, 2022, 2,665,074 free performance shares granted to the Chief Executive Officer of the Company under the 2022 Long-Term Incentive Plan (LTIP) were outstanding, which may be vested in whole or in part by their beneficiary depending on the performance conditions defined by said Plan as described in detail in Chapter 4: “Corporate Governance and Compensation”, section 4.2.4 “Stock Option Plans and Performance or Free Share Plans” of this Universal Registration Document). If all the shares granted under this Plan were issued, 2,665,074 shares would be issued. Vantiva’s share capital would then be composed of 358,060,754 ordinary shares, which would represent a 0.75% increase in the number of shares at December 31, 2022.

As of December 31, 2022, a total of 15,288,534 Shareholders Warrants (for more details on these Shareholders Warrants, see section 1.4.1.2 above in this chapter) could still be exercized. If all these Shareholders Warrants were exercized, 32,072,286 shares would be issued. Vantiva’s share capital would consist of 387,467,966 ordinary shares, which would represent a 9% increase in the number of shares at December 31, 2022.

The cumulative exercize of all the aforementioned stock options, the vesting of all the aforementioned shares and the exercize of all the aforementioned Shareholders Warrants would result in the issue of 34,768,723 shares. Vantiva’s share capital would then be composed of 390,164,103 ordinary shares, which would represent a 9.78% increase in the number of shares at December 31, 2022.

In addition, it should be noted that between December 31, 2022 and the date of publication of this Universal Registration Document, 7,995,223 free performance shares were granted and distributed among the members of the Vantiva Executive Committee under the 2022 Long-term Incentive Plan (LTIP) and are outstanding. These shares may be vested in whole or in part at the expiry of the Plan according to the performance conditions defined by said Plan as described in detail in Chapter 4: “Corporate Governance and Compensation”, section 4.2.4 “ Stock Option Plans and Performance or Free Share Plans” of this Universal Registration Document). If all the shares granted under this Plan were issued, this would result in an issue of 7,995,223 shares, representing an increase of 2.25% in the number of shares at December 31, 2022.

Pledge of Vantiva shares

To Technicolor’s knowledge, no Company shares are pledged as of the date of publication of the Universal Registration Document.

Elements likely to have an influence in the event of a public offer

Pursuant to Article L. 225-100-3 of the French Commercial Code, the agreements governing the New Money debt, and the Reinstated Term Loans to which Group companies are parties contain change of control clauses. For more information on these agreements, please refer to Chapter 2: “Operating and financial review and prospects”, section 2.3.3: “Financial resources” of this Universal Registration Document.

-

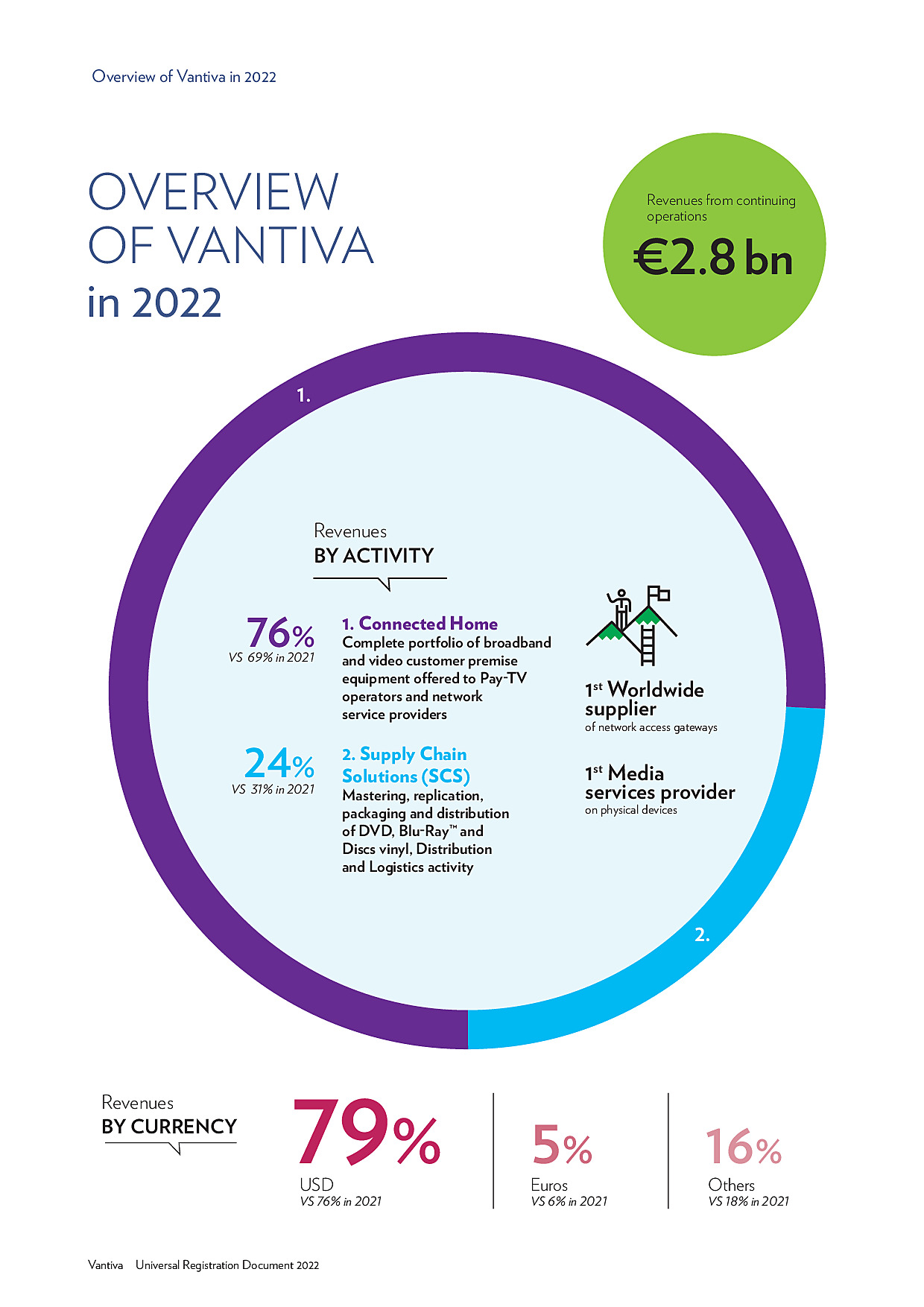

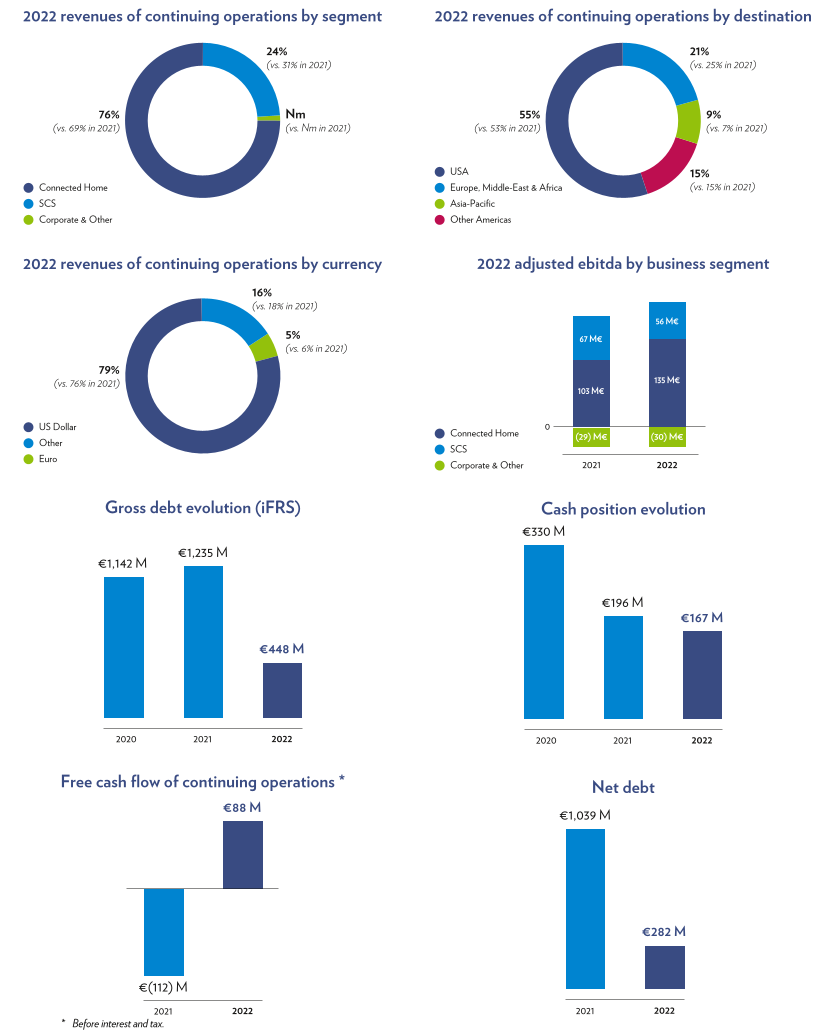

2.1Summary of results

Revenues from continuing operations totaled €2,776 million in 2022, up 23.4% at current currency and up 11.4% at constant currency compared to 2021. For more information, please refer to section 2.2.1: “Analysis of revenues from continuing operations” of this Chapter.

Adjusted EBITDA from continuing operations reached €161 million in 2022, up 14.3% at current currency and up 3.7% at constant currency compared to 2021. The Adjusted EBITDA margin amounted to 5.8%, down by 46 basis points (bps) year-on-year at current currency. This decline reflects a slightly lower margin for both divisions and the higher weight of Connected Home division in the group’s total as this division generates a lower margin than SCS in percentage terms. For more information, please refer to sections 2.2.2: “Analysis of Adjusted EBITDA and adjusted EBITA” and 2.2.10: “Adjusted indicators” of this Chapter.

Profit from continuing operations before tax and net finance costs was a loss of €11 million in 2022 compared to a loss of €13 million in 2021. For more information, please refer to section 2.2.3: “Analysis of operating expenses and profit (loss) from continuing operations before tax and net financial expense” of this Chapter.

The Group’s net financial result was an expense of €177 million in 2022 compared to an expense of €117 million in 2021. For more information, please refer to section 2.2.4: “Net financial expense” of this Chapter.

The Group’s total charge tax was €30 million in 2022 compared to a charge of €14 million in 2021. For more information, please refer to section 2.2.6: “Income tax” of this Chapter.

The Group Loss from associates was a loss of €311 million resulting from the write-down of TCS shares to market value. For more information, please refer to section 2.2.5 ”Loss from associates” of this Chapter.

Loss from continuing operations was €529 million in 2022 compared to a loss of €143 million in 2021. For more information, please refer to section 2.2.7: “Profit (loss) from continuing operations” of this Chapter.

-

2.2Results of operations for 2021 and 2022

For the full year 2022, Vantiva met its 2022 guidance, with adjusted EBITDA reaching €161 million, adjusted EBITA €55 million, and Free Cash Flow before Tax and Financial €88 million. The group’s growth has been fueled by higher broadband volumes thanks to the success of our Fiber and Wi-Fi 6 offerings, price increases to partially recover cost inflation, and improved product mix at the Connected Home division. Supply Chain Solutions’ performance has been negatively impacted by lower demand for optical discs against a strong base of comparison.

Vantiva revenues totaled €2,776 million, up 23.4% (+11.4% at constant exchange rate). Connected Home revenues amounted to €2,120 million for the fiscal year, an increase of 37.3% (+23.3% at constant exchange rate). Supply Chain Solutions revenues were €655 million, down 6.6% (-14.3% at constant exchange rate).

Adjusted EBITDA improvement stems from the product mix-effect for Connected Home, better pass-through of additional costs versus last year, and strict cost control in both divisions.

The group’s adjusted EBITDA reached €161 million in the year, a €20 million improvement over last year. The margin dilution, from 6.3% to 5.8%, resulted from the higher contribution of the Connected Home division to the group’s adjusted EBITDA (+10pts) and a lower gross margin in percentage terms.

Connected Home contributed €135 million (versus €103 million last year) to adjusted EBITDA while Supply Chain Solutions contributed €56 million (versus €67 million last year).

FCF, before financial and tax, in the year was positive at €88 million, showing a €200 million improvement over last year, largely explained by the change in working capital. IFRS net debt amounted to €263 million as of December 31, 2022.

The Group’s results are presented in accordance with IFRS5. Consequently, the contributions of discontinued operations are disclosed on one line in the consolidated statements of operations, named “Net profit (loss) from discontinued operations” and are presented separately under section 2.2.7: “Profit (Loss) from Discontinued Operations” of this Chapter.

2.2.1Analysis of revenues from continuing operations

2022 Revenues stood at €2,776 million, representing a 23.4% increase (+11.4% at constant exchange rate). The United States remained the first market of the group with 58% of revenues compared to 52% the previous year. The strong improvement of Connected Home (+23.3%) at constant rate was driven by North America, broadband products, and forex, more than offsetting the decline of Supply Chain Solutions (-14.3%) at constant rate, which was hit by lower optical disc demand.

Connected Home

Connected Home revenues contributed 76% of group revenues (69% in 2021) and totaled €2,120 million in 2022, up 37.3%. At constant exchange rate, the growth would have been +23.3% compared with 2021. This revenue development has been driven by the combined positive effect of pricing and product mix outweighing the volume decrease. Broadband business has been the main growth driver in the year representing 75% of revenues versus 64% the prior year, while demand for video devices suffered in some geographies, especially in India.

Globally, delivered units were down 4.4%, mostly due to a drop in demand in Asia Pacific, notably in India and for entry-level video products.

Revenue breakdown by product

Supply Chain Solutions

Supply Chain Solutions revenues totaled €655 million in 2022, down 6.6% from 2021. At constant exchange rate, the decline would have been 14.3%. Beyond the structural decline of the optical disc activity, the performance of the year has been severely impacted by the decline in demand from one major customer and a high base of comparison. Distribution and freight businesses were also down in the year. While growing, the other activities, have not been able to offset entirely this decline. The group has successfully launched vinyl production delivering its first 2 million albums in the year. Performance was however penalized by a slower intake of new vinyl presses than planned due to delivery delays, which prevented us from meeting the strong demand.

Business Highlights

Volume breakdown

Supply Chain Solutions volumes were down 37.3% year-on-year compared to the previous year's annual decline of 2.7%.

Corporate & Other

-

2.3Liquidity and capital resources

This section should be read in conjunction with Chapter 3: “Risks, Litigation, and Controls”, section 3.1.1: “Global market and industry risks” of this Universal Registration Document, and note 8 to the consolidated financial statements.

2.3.1Overview

2.3.1.1Principal cash requirements

- •Working capital requirements from continuing operations: the working capital requirements of the Group are based in particular on the level of inventories, receivables, and payables;

- •Losses relating to discontinued operations: the Group must also fund the losses and cash requirements, if any, of its discontinued operations. For more information on the risks associated with the sale of these activities please refer to Chapter 3: “Risks, litigation and controls” section 3.1: “Risk Factors” of this Universal Registration Document;

- •Capital expenditures: the Group must regularly invest in capital equipment to operate its businesses;

- •Repayment or refinancing of debt: at each debt maturity date, the Group must either repay or refinance the maturing amounts;

- •Dividends: in 2022 no dividend was paid, but the Group may have to fund future dividends.

2.3.1.2Key liquidity resources

- •Cash and cash equivalents: the amount of cash and cash equivalents was €167 million on December 31, 2022. In addition, €40 million in cash collateral and security deposits was outstanding on December 31, 2022, to secure credit facilities and other Group obligations;

- •Cash generated from operating activities;

- •Proceeds from sales of assets: in accordance with the Group’s debt documentation, the proceeds from the sale of assets must be used in some cases to repay the debt;

- •Committed credit lines: on December 31, 2022, the Group had one credit line for an amount of €117 million secured by trade receivables the availability of which varies depending on the amount of receivables. For more information about the Group’s credit lines please refer to note 8.5.5 to the Group’s consolidated financial statements.

-

2.4Subsequent events

Technicolor Creative Studios announced on March 8th 2023, before market opening, that it had reached with its main shareholders and lenders an agreement of principle for its refinancing. Vantiva is supporting this agreement.

-

2.5Pro forma financial information

Context and regulatory framework

The pro forma consolidated financial information, which includes pro forma selected items of the consolidated statement of operations for the year ended December 31, 2022 reflects the impacts of the distribution of a 65% stake in Technicolor Creative Studios (TCS) to Technicolor shareholders (the “Distribution”) that occurred on September 27, 2022 and the refinancing of the Vantiva group closely linked to this Distribution (the “Refinancing”), considering the assumption that the Distribution and the Refinancing had taken place on January 1, 2022.

This pro forma consolidated financial is prepared in accordance with Appendix 20, “Pro forma information” of the Commission Delegated Regulation (EU) no. 2019/980 supplementing European Regulation no. 2017/1129, the recommendations issued by ESMA (ESMA 32-382-1138) and in accordance with Guideline no. 2021-02 of the French Financial Markets Authority (”Autorité des Marchés Financiers” or “AMF”).

The pro forma consolidated financial information, prepared for illustrative purposes only, presents a hypothetical situation, and therefore is not representative of the results of operations of the Vantiva group that would have been achieved if the Distribution had been finalized on January 1, 2022, or the future results of the Group.

-

2.6Statutory auditors’ report on the Pro Forma Financial

In our capacity as statutory auditors of your company and in accordance with Regulation (EU) n°2017/1129 supplemented by the Commission Delegated Regulation (EU) n°2019/980, we hereby report to you on the pro forma financial information of Vantiva (the “Company”) for the year ended 31 December 2022 set out in section 2.6 of the universal registration document (document d’enregistrement universel) (the “Pro Forma Financial Information”).

The Pro Forma Financial Information has been prepared for the sole purpose of illustrating the impact of the distribution of a 65% stake in Technicolor Creative Studios (TCS) to Technicolor shareholders (the “Distribution”) that occurred on September 27, 2022 and the refinancing of the Vantiva group closely linked to this Distribution (the “Refinancing”) might have had on the consolidated income statement of the Company for the year ended 31 December 2022 had it taken place with effect from 1 January 2022. By its very nature, this information is based on a hypothetical situation and does not represent the financial position or performance that would have been reported, had the operation or event taken place at an earlier date than the actual or contemplated date.

It is your responsibility to prepare the Pro Forma Financial Information in accordance with the provisions of Regulation (EU) n°2017/1129 and ESMA’s recommendations on Pro Forma Financial Information.

It is our responsibility to express a conclusion, based on our work, in accordance with Annex 20, section 3 of Commission Delegated Regulation (EU) n°2019/980, as to the proper compilation of the Pro Forma Financial Information on the basis stated.

We performed those procedures that we deemed necessary according to the professional guidance of the French Institute of Statutory Auditors (“CNCC”) applicable to such engagement. These procedures, which did not include an audit or a review of the financial information used as a basis to prepare the Pro Forma Financial Information, mainly consisted in ensuring that the information used to prepare the Pro Forma Financial Information was consistent with the underlying financial information, as described in the notes to the Pro Forma Financial Information, reviewing the evidence supporting the pro forma adjustments and conducting interviews with the management of the Company to obtain the information and explanations that we deemed necessary.

- •the Pro Forma Financial Information has been properly compiled on the basis stated;

- •that basis is consistent with the accounting policies of the issuer.

-

3. Risks, litigation, and controls

Strong risk monitoring & mitigation efforts

104 security audits supported

in 20222022 Internal Control campaign

1,289 self-assessment controls supported

by 127 control ownersThe first section of this Chapter describes the main risks identified by the Group that could affect its businesses, financial situation or sustainability. Additional risks which are either not identified, or which are considered today as minor, may also have a significant impact on the Group’s performance.

-

3.1Risk factors

The following risk factors are limited to risks which are specific to the Issuer and which are material for taking an informed investment decision, as corroborated by the content of the Issuer’s Universal Registration Document. In each category below, the Issuer, in its assessment, is taking into account the expected magnitude of the negative impact of such risks and the probability of their occurrence.

This description, made of explanations of each individual risk, managing and monitoring actions and completed with an indication of the risk trend, increasing , stable and decreasing , is not intended to be exhaustive and potential investors should make their own independent evaluations of all risk factors and should also review the detailed information set out elsewhere in this Universal Registration Document (Document d’enregistrement universel).

The classification of the risks relating to business, financial, and market risks below are the result of a regular analysis as part of the Issuer’s internal risk management process which appears in part "Risk Management" of section 3.2.2 of this Universal Registration Document, after taking into account any mitigation measures resulting from such internal risk management process.

The risks that Vantiva considers to be the most significant are pointed out by one on account of their occurrence probability and/or the seriousness of their prejudicial characteristics.

Operational risks

Connected Home (CH)

Supply Chain Solutions (SCS)

- •Supplier Dependency µ

- •Raw Material and Other Key Input Dependency

- •Client Concentration and Dependency µ

- •Customer Concentration and Contract Negotiation µ

- •Intellectual Property (IP)

- •Supply Chain and Manufacturing

- •Labor Force Availability

3.1.1Global market and industry risks

Health and safety

GRI [3-3 Management of material topics: Occupational health and safety] [403-5]

Risk identification

Risk monitoring and management

Workplace health and safety risks are generally identified through an occupational risk assessment process. When risks cannot be eliminated directly or reduced acceptably, the remaining risks are mitigated through training and protective/assistive equipment.

Regarding industrial sites, the Group operates three DVD and Blu-ray™ replication sites (two main locations in Mexico and Poland, and a smaller one in Australia) and one CPE (Consumer Premises Equipment) assembling site (Brazil). The packaging and distribution centers of the Supply Chain Solutions division are also industrial in nature with equivalent but different risks, and they are located mainly in the U.S., Mexico, United Kingdom, and Australia. Remaining non-industrial locations bring moderate risks, above those of an office due to the active laboratory nature of the CPE business, but in many ways lower risk than the industrial operations of the Company.

While industrial sites have inherently higher risks for health and safety, the risk identification process relies in all cases on a written occupational risk assessment process.

The Group seeks to promote the health and well-being of its employees and sustain their long-term performance, which necessitates a safe workplace. We are therefore committed to taking our health and safety culture to the next level.

Normally, standard and regular health and safety training, as well as relevant personal protective equipment, are delivered to the Group’s employees as well as to the agency workers and contractors working in our locations to prevent work-related injuries and incidents as part of global prevention programs.

Vantiva has been closely monitoring the evolution of the Covid-19 pandemic and has taken all appropriate measures to ensure the safety of its employees and support its customers throughout this difficult period. The Group has also evaluated any potential impacts on production and deliveries and mitigated the related risk via alternative plans where necessary. The Group has successfully implemented work-from-home arrangements where possible to ensure continuity and productivity across the Group. For further details on health and safety actions conducted by the Group, refer to Chapter 5, section 5.2.5: “Health & Safety at work” of this Universal Registration Document.

Economic, GEOpolitical & social environment

GRI [3-3 Management of material topics: Economic performance]

Risk identification

Risk monitoring and management

The prospects of inflation and a global recession are common variables that influence how network service providers (NSPs) in different regions assess their strategic Customer Premises Equipment options (CPE). Local market conditions determine the pace at which new technologies are deployed and new services adopted for Connected Home applications. Any further deterioration in the macroeconomic and geopolitical environment may adversely affect the supply chain, consumer confidence, disposable income, and spending, and result in decreased volumes for some of the Group’s products/services or increased demand for lower-end products at the expense of higher-end products/services we provide. For example, Vantiva is well established in Latin America through the Connected Home and Supply Chain Solutions divisions, and the economic uncertainties, as well as the impact on the value of the local currency in this area, may negatively impact the revenue and results. In addition, local labor regulations forbidding more flexible types of contracts could induce more benefit charges and thus increase the total cost of labor.

More specifically, pandemics and/or other natural disasters directly impact employees, facilities, talent recruitment, clients, vendors, and operations, along with upstream impacts (shift to streaming platforms, loss of theatrical exhibition) on our businesses. In addition, supply chain disruption may not be covered by insurance as a result of market tightening.

Furthermore, deterioration in general economic conditions may result in an increasing number of the Group’s customers becoming delinquent on their obligations to the Group or being unable to pay, which in turn could result in a higher risk of credit losses, and ultimately a negative impact on our supplier base. Any prolonged global economic downturn may therefore have adverse effects on the Group’s operating results or financial condition.

Major events such as the commercial war between the United States of America and China, Hong Kong political instability, and the ongoing Russo-Ukrainian war may have negative impacts on the Group's performance. Particularly, Russia's invasion of Ukraine on February 24, 2022, and the subsequent international sanctions against Russia were identified as events whose geopolitical impact and consequences on the global economy may be very significant. Consequently, the disruption of global access to Ukrainian minerals and natural resources utilized in global manufacturing, as well as the need to modify transportation routes by avoiding Russian, Belarusian, and Ukrainian territories, places additional strain on logistical and supply chain operations.

The Group’s presence in geographically diversified markets makes it less sensitive to adverse economic conditions in a given market.

Risks concerning the regulatory, political, and social environment are managed by each business and at the Group level by the Audit Committee, either in a decentralized form for risks specific to a given activity or through support functions. They are regularly reviewed in detail by Group Management as part of the Monthly or Quarterly Business Review meetings.

As proactive measures against the possible impact of general economic conditions on customers, the Group’s Finance Department has long-standing policies in place for regular monitoring of debtors and credit checks on new clients.

Regarding the Russo-Ukrainian war and in the specific case of the Group, no significant potential impact has been identified at this stage, as the Group has no – or almost no – business relationship with either of these two countries and does not hold any assets there. In addition, any new business relationships that may be established, as well as financial and material flow to and from these countries and Belarus, are closely monitored in all operating divisions and are complying with all the international sanctions imposed against Russia. With regard to Connected Home and its operations, transport of products from Asia to Europe which entailed transit across Russia is temporarily suspended and is under review while regular communications with the key suppliers are ongoing in order to assess the impact on the supply chain.

Moreover, Vantiva is anticipating that in most parts of the world, NSPs could experience weaker demand due to consumers trying to spend less by lowering their connectivity and TV bill and overall spending. That could result in NSPs trying to lower their capex spending in 2023, such as ordering fewer units from Vantiva, while if this was to happen, 2024 should see volumes resume to previous levels.

Attract talent & invest in culture

GRI [3-3 Management of material topics: Employment] [3-3 Management of material topics: Training and education] [3-3 Management of material topics: Diversity and equal opportunity]

Risk identification

Risk monitoring and management

The Group depends on the continuous recruitment and engagement of key team members, with strong skill sets (technical, operational, etc.) depending on what business division or transversal function they belong to, and industry knowledge (entertainment, logistics, telecommunication/IoT, etc.). In addition, the technology experts are essential team members to improve the quality of the products we develop and support operational/financial systems.

The absence of a strong People & Talent (formerly known as Human Resources) strategy/value proposition, cultural initiatives for inclusion, and an adequate employer branding program may lead the Group to be less attractive. Coupled with the post-pandemic challenges (which resulted in changes in candidates' expectations) and Transition Service Agreement (TSA) in place, the Group may experience a longer recruitment process, and/or talents may be less motivated to join or remain in the Group.

The new working environment will entail significant work-from-home scenarios. A lack of initiatives to strengthen the collaborative culture could result in a sense of isolation, mental health challenges, unethical behavior, and/or inefficiencies.

To limit the impact that these risks might have, People & Talent have reengineered their missions, operations, and programs to better suit the current environment and business needs. These initiatives include recruitment programs, annual talent reviews, and the launch of a global Diversity, Equity, and Inclusion program that aimed at demonstrating the Group’s long-term commitment to celebrating our differences and representing the diversity of the communities and clients we serve.

Since 2020, and under the restrictions generated by the Covid-19 pandemic, training sessions were partially migrated to live virtual delivery, ensuring flexibility and scalability.

Furthermore, Vantiva is using Smart Recruiters software for the entire hiring process (job ad, resume, schedule interviews, etc.) enhancing efficiency for the Group, as well as, providing a better experience for the new hires and the hiring managers. Together with the new onboarding process going live in all countries with our current tools (HR Online and People Doc), these changes will strengthen People & Talent process, increase automation, and limit the possibility of system failures.

As an element of differentiation to attract and retain employees, Vantiva strives continuously to improve its benefits policy. Surveys were launched to check employees’ morale and mindset for those employees who were working from home for long periods as well as a global employee engagement survey to identify the expectations at the time most employees returned to the office. Soft skills training was delivered to support the change in working relations. A worldwide Diversity, Equity, and Inclusion initiative targeting all employees’ communities was also launched with local involvement.

Diversity and human rights

GRI [2-26 Mechanisms for seeking advice and raising concerns] [3-3 Management of material topics: Training and education] [3-3 Management of material topics: Diversity and equal opportunity] [3-3 Management of material topics: Non-discrimination] [3-3 Management of material topics: Supplier social assessment]

Risk identification

Risk monitoring and management

Technical and innovative industries like Connected Home require a diversity of talent to be able to create complementary teams delivering outstanding sustainable performance through agility, team playing, and resilience. Gender diversity is the most challenging one given the lack of women coming from engineering universities and attracted by our industry. Depending on the country where the Group operates, obstacles may be overtaken by closer relationships with preferred universities and by setting up women-dedicated hiring initiatives (social media and traditional hiring fairs). Risks here are not being able to fill open jobs in a timely manner with exemplary candidates and not refreshing the workforce fast enough, leading to a lack of creativity and an inability to upgrade our global performance capabilities.

Manufacturing, packaging, and logistics industries like Supply Chain Solutions require a diversity of talent to mirror the local employment mix and to reinforce engagement with local communities. Obstacles can be political decisions on immigration quotas, that would block access to the seasonal workforce, mainly a cross-border workforce, in a timely, quantitative, and qualitative manner, or labor law changes impacting flexibility in the access to the local labor market. Generally speaking, gender, culture, education, and experience are key elements to factor in all internal policies to ensure proper mix and equitable treatment in every employee’s career progression.

As in any organization, discrimination, and harassment may occur. Beyond the fact that these behaviors are totally unacceptable, such behaviors are also detrimental to the attractiveness and retention of talent, the safety of the operations, as well as, to the reputation of the Group.

Supply chains and logistics are becoming more complex, with an increased number of stakeholders and levels of subcontracting. Detection and prevention of human rights violations in the supply chain is essential, together with active intervention and remediation in case of any occurrence.

Internal proactive policies to increase the proportion of women in management positions in the Group are the first lever. Developing the Group’s attractiveness as a place to work (responsibility, engagement, development, etc.) allows us to better absorb changes of regulation, compared to the competition, that may affect the Group’s talent diversity.

Employee training is organized to raise awareness of harassment, and discrimination, and to help prevent and identify such incidents. A whistleblowing hotline is open to receive harassment and discrimination alerts. Sanctions may be taken after investigation and conviction.

Supplier risk mapping is regularly maintained, together with physical on-site audits of higher-risk suppliers (country and/or activity). The Group Whistleblowing procedure is also open to collect alerts in this area. Contracts with suppliers include terms and conditions forbidding human rights violations, and in the case of any incident, impose sanctions, including immediate termination for the most serious violations. Alternative suppliers are always considered to prevent production disruption.

Skills & knowledge management, development & retention

GRI [3-3 Management of material topics: Training and education]

Risk identification

Risk monitoring and management

The Group relies significantly on the talent strategy based on three main pillars:

- define the right mix of unlimited and limited contracts to mitigate the reasonability effect and optimize labor cost structure, mainly in Supply Chain Solutions;

- define the right footprint to optimize efficiency, ensure customer proximity and cost scalability; and

- identify critical positions and skills instrumental to achieving the 3 years strategy plan and ensure backup solutions if these employees were to leave the Group (e.g., Product Managers, Key Account Managers, Finance leaders, IT legacy systems experts, etc.).

In addition, not having the proper process and tools in place for assessing employees’ skills versus required skills profiles per job may prevent the Group from creating the proper Talent and Development Plan for existing employees (i.e., training of soft and technical skills). A lack of an identification process of key talents (such as emerging leaders or critical experts) may prevent the Group from building robust success planning mapping and retaining employees.

Given the past year's tension in key labor markets such as US, Poland, India, and France, the ability to build a strong employer branding is becoming more sensitive, as well as, ensuring that Group’s values are conveyed across the company and embraced by all employees. This should be reflected both externally and internally at all stages of the employee lifecycle to attract, engage and retain them.

The separation of Technicolor Creative Studios in September 2022 necessitated the division of the shared functions of the Group (Finance, IT, HR, etc.). The process to design and implement the new organizations for each company is complex and time-consuming and created uncertainty for the teams impacted by the separation project. This situation increases the risk of attrition in these teams and therefore, a risk that the company cannot adequately deliver the transition services and separation program.

Several programs have been implemented across the Group to ensure proper knowledge retention including formalization and/or documentation of cross-training initiatives of key business activities:

- •The successful implementation of the Learning Management System (LMS) in July 2021 was enhanced by the development of a training service catalog made of both the Cornerstone Learning & Development platform and training modules created and delivered by the Group Internal Talent and Development Team. A compliance learning program was launched in 2022, to ensure full awareness to newcomers, as well as, refresh existing employees on local regulation changes associated with our businesses. Attrition levels in the transition services teams are monitored and reported monthly to the transition services governance to ensure issues are identified and appropriate actions are taken.

- •In 2021, Vantiva launched a management training program in each of its businesses (Connected Home and Supply Chain Solutions). In Connected Home, the program is called Empower and was open to 200 managers. The program covered many topics such as leadership, feedback, managing change, managing diversity, and emotional intelligence. This content was delivered using blended learning, mixing instructor-led training and e-learning. The program was made of 8 modules of 1 hour each and approximately 2 hours of e-learning. Given the success of this program, Vantiva has decided to continue delivering it in 2023 to all new managers. The Supply Chain Solutions division rolled out a leadership cohort training in 2022 to more than 90 managers of the Memphis facility. The program was made of 3 sessions of 4 hours each covering leadership topics such as effective decision-making, team engagement, entrepreneurial thinking, and managerial courage.

Succession plans (immediate, mid-term, and long-term) involving the identification of critical experts and emerging leaders are part of the risk management support provided by the People & Talent organization. Succession plans, including mitigation plans, are assessed by the business divisions and rolled out at the Group level. Once shared at the Group ExCom level, and approved by the Chief Executive Officer, the plans are presented to the Governance and Corporate Social Responsibility Committee.

Securing, keeping, and developing valuable talents remains one of the key drivers for the Group’s sustainable success. Individual contribution to teams' success is assessed not only on a yearly basis but through a yearlong continuous feedback process to ensure full alignment of objectives, means, and engagement.

An engagement program for the transition services teams has been developed that includes regular communication with all people managers, identification of training needs, a simplified process to retain potential leavers, and a retention bonus scheme for all impacted team members.

Cybersecurity

GRI [3-3 Management of material topics: Customer privacy]

Risk identification

Risk monitoring and management

The secure maintenance and transmission of the Group's and customers’ information is an essential component of the Group’s operations due to highly sensitive and confidential content. In that optic, cloud enablement and usage/support continue to evolve. The failure to have sufficient and effective content security systems and protocols both onsite and during remote working scenarios may lead to loss, disclosure, misappropriation, alteration, and unauthorized sharing and access to sensitive information and assets (Intellectual Property).

Product developments may become more expensive or take a longer time than initially planned due to unexpected challenges in the development cycle, potential quality issues linked to the technological complexity of the products, resource constraints, or dependency on third-party deliveries.

Products and data may be vulnerable due to the increase in volume and sophistication of hacking or other types of malicious attacks (e.g., phishing) which expose the Group to liabilities, extra cost for remediation, or compensation for prejudices.

New vulnerabilities must be identified and monitored appropriately to avoid successful operational attacks. Log data from infrastructure and applications in the environment are the core of identifying or investigating security events and potential incidents. If log forwarding from key devices is interrupted for a significant period, it will reduce the SOC (Security Operations Center) operational capabilities. A lack of consistent procedures could impact our ability to successfully back up and restore systems. It is feasible that a flood of security breaches, incidents, or attacks could overwhelm the SOC's capability to manage, investigate and escalate them.

The global pandemic environment over the last several years led to an increase in hybrid working environments and remote working environments which require additional security and access protocols/assessments for both access solutions and devices. Failure to properly monitor equipment use and access rights could result in confidential information being shared with competitors or customers.

Failure of employees’ awareness of cyber risks increases the risk of phishing campaigns and introducing malware in our systems. Those consequences may drive key customers to withdraw work from the Group and are likely to expose the Group to significant financial burdens, liability, loss of reputation, and loss of revenues.

The security actions related to Supply Chain Solutions customer content are led by internal security teams which focus on the mitigation of these risks. These security actions and protocols are continuously implemented, enforced, evaluated, and updated as needs evolve, and as new technologies or threats emerge.

The Connected Home centers for product development or implementation of services include quality assurance functions that are responsible for establishing and measuring suitable quality indicators and developing action plans to improve the quality of the products and services with management reviews at key milestones.

To ensure high-security standards, a security approval procedure is in place for the new products delivered by the Connected Home division. This procedure is part of the product development project management methodology. Once products are delivered, an incident response procedure is in place to support customers. This procedure includes a vulnerability disclosure protocol, to allow security researchers to report any weakness in Connected Home products and allow us to address risks before public disclosure and/or materialization of said risk.

The security policies and the use of qualified suppliers, equipment, and software, combined with regular security training, security assessments, and penetration testing, aim to mitigate the risk to an acceptable level. For physical security risks, a dedicated team conducts risk assessments on all critical sites and suggests a remediation plan for local security coordinators when needed. In 2022, working in collaboration with clients and industry organizations, the Group has continued to establish and promote secure work-from-home environments and workflows where required based on local government requirements.

The Group security standards are continuously reviewed and updated to stay current with the industry and with established security policies. Overall, in 2022, the Group supported over 104 security audits, which included a combination of internal and external audits. Audit findings are tracked and managed by internal teams.

In 2022, the Group delivered security awareness training to all employees and provided multiple communications around phishing, malware, and general security practices, with an increased focus on the impacts of an increase in remote work.

Since its introduction in 2015, the Group Cybersecurity Program is recalibrated quarterly, and its initiatives are tracked regularly. Cybersecurity technology teams have enabled faster adoption of enterprise-scale tools and processes in partnership with the Global Security teams. Architecture, continuous implementation, enforcement, evaluation, and update of security actions, protocols, and standards in new production facilities are being performed. On the other hand, tracking and management of items identified for remediation, led by internal teams within Service Now central repository are managed and reported by the Group Security Operations Center (SOC).

Business continuity

GRI [2-16 Communication of critical concerns]

Risk identification

Risk monitoring and management